Risk Management Portfolio

Navigating today's complex risk landscape requires sophisticated tools. The Risk Management Portfolio provides a unified solution for managing financial, operational, and environmental risks, enabling organizations to stay ahead and make strategic decisions.

Transforming Enterprise Risk Management: A Comprehensive Case Study

In today’s multifaceted business landscape, effective risk management is crucial for sustained success. The Risk Management Portfolio is an advanced tool designed to address the diverse challenges associated with financial, operational, and environmental risks. This case study provides a comprehensive look into the portfolio’s features, design philosophy, and the significant advantages it offers to organizations.

Client Objective & Challenges

Addressing Complex Needs: Our client sought a comprehensive and centralized Enterprise Risk Management (ERM) Dashboard capable of unifying diverse and complex datasets into a single, cohesive analytical tool. Their goal was to streamline risk assessment processes across various departments, enabling real-time insights, predictive analytics, and enhanced decision-making capabilities. This dashboard needed to accommodate the intricate nature of risk data from multiple sources, including financial metrics, compliance records, operational risks, and environmental factors, all within a user-friendly interface designed for seamless integration into their existing workflows.

Key challenges included:

Disparate Data Silos: Fragmented data sources obstructing comprehensive risk analysis.

Lack of Real-Time Oversight: Insufficient visibility into critical risk areas.

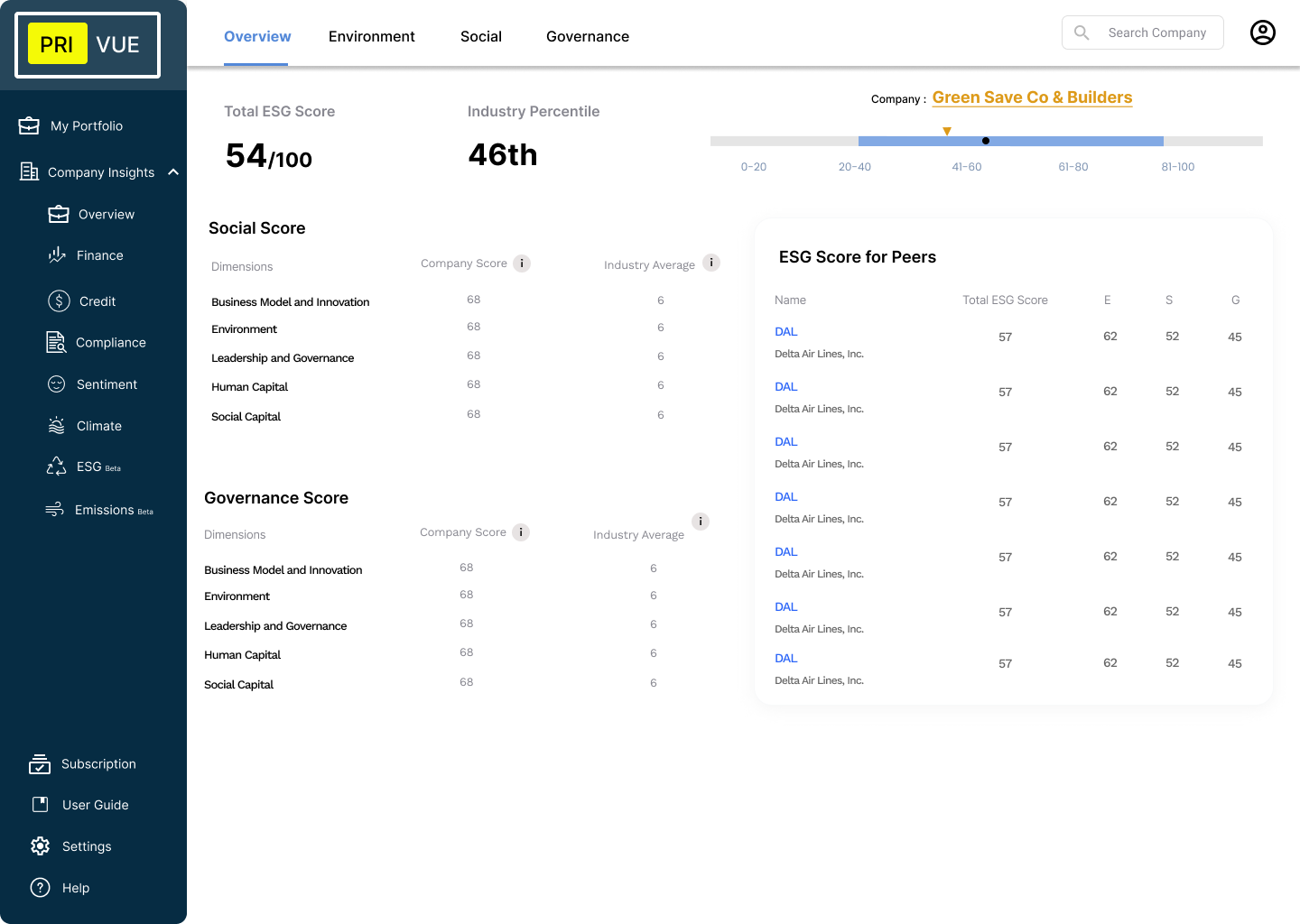

Demand for ESG Metrics: Growing need for rigorous tracking of environmental, social, and governance (ESG) metrics.

Solution Overview & Benefits

Comprehensive Feature Integration:

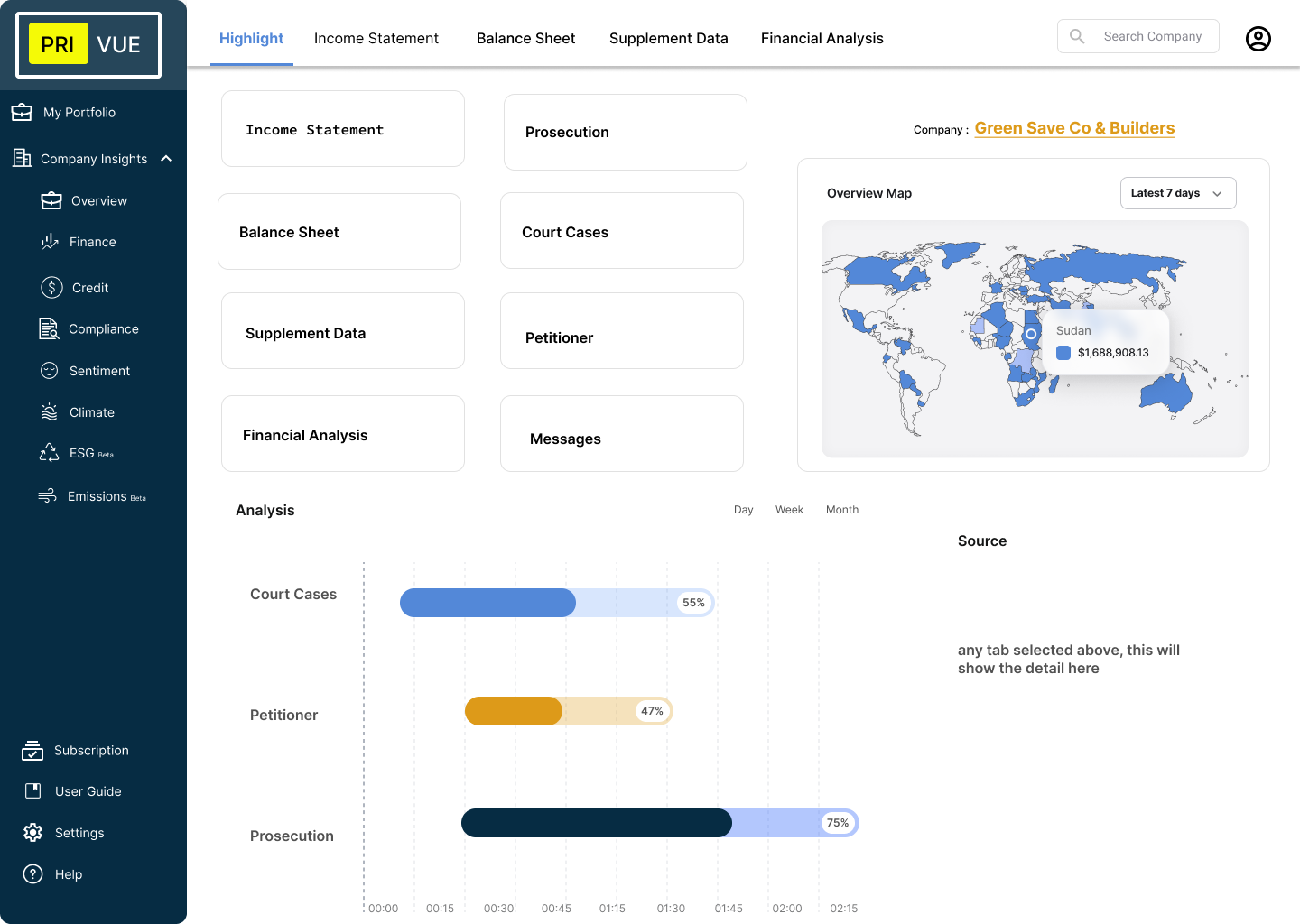

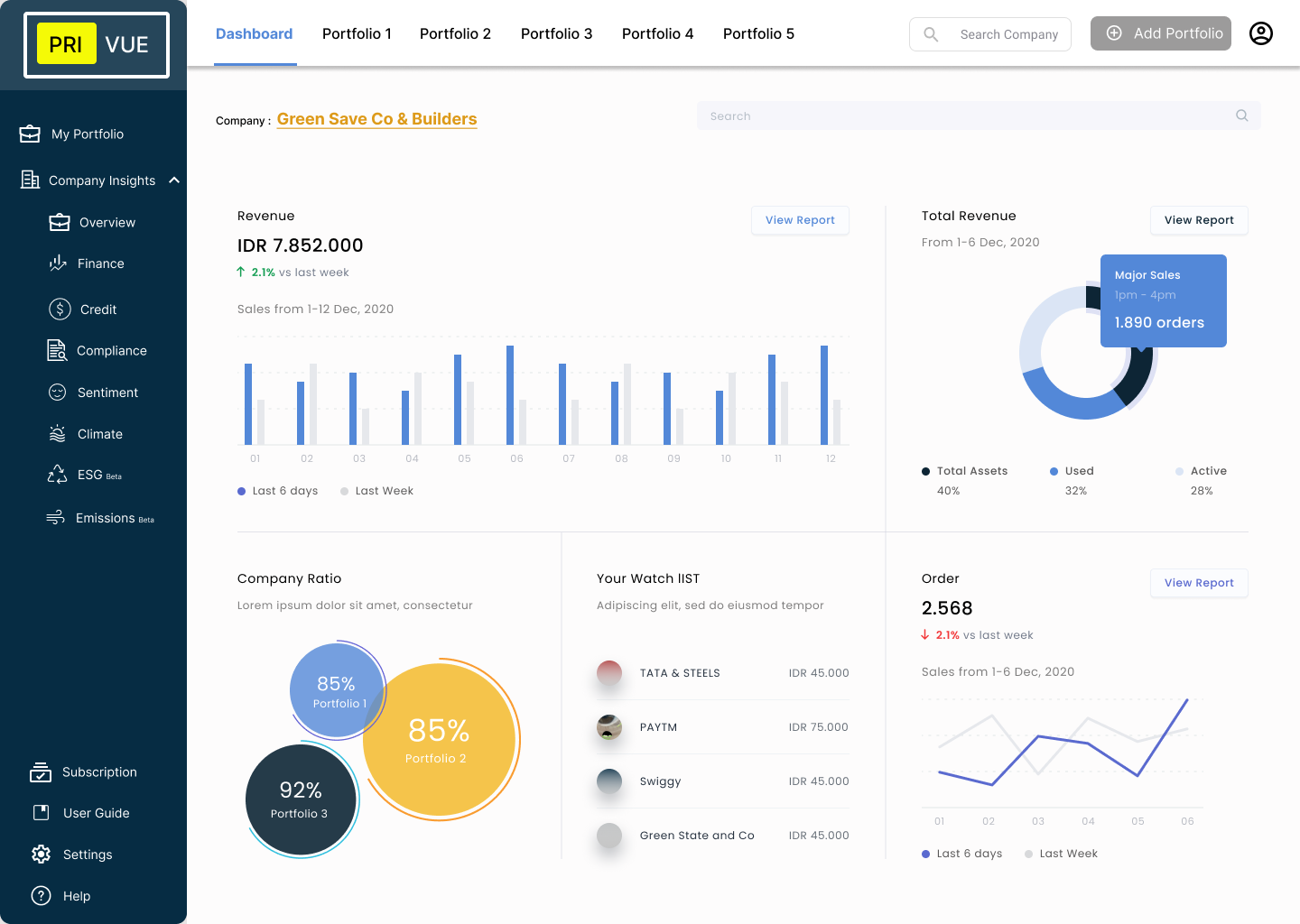

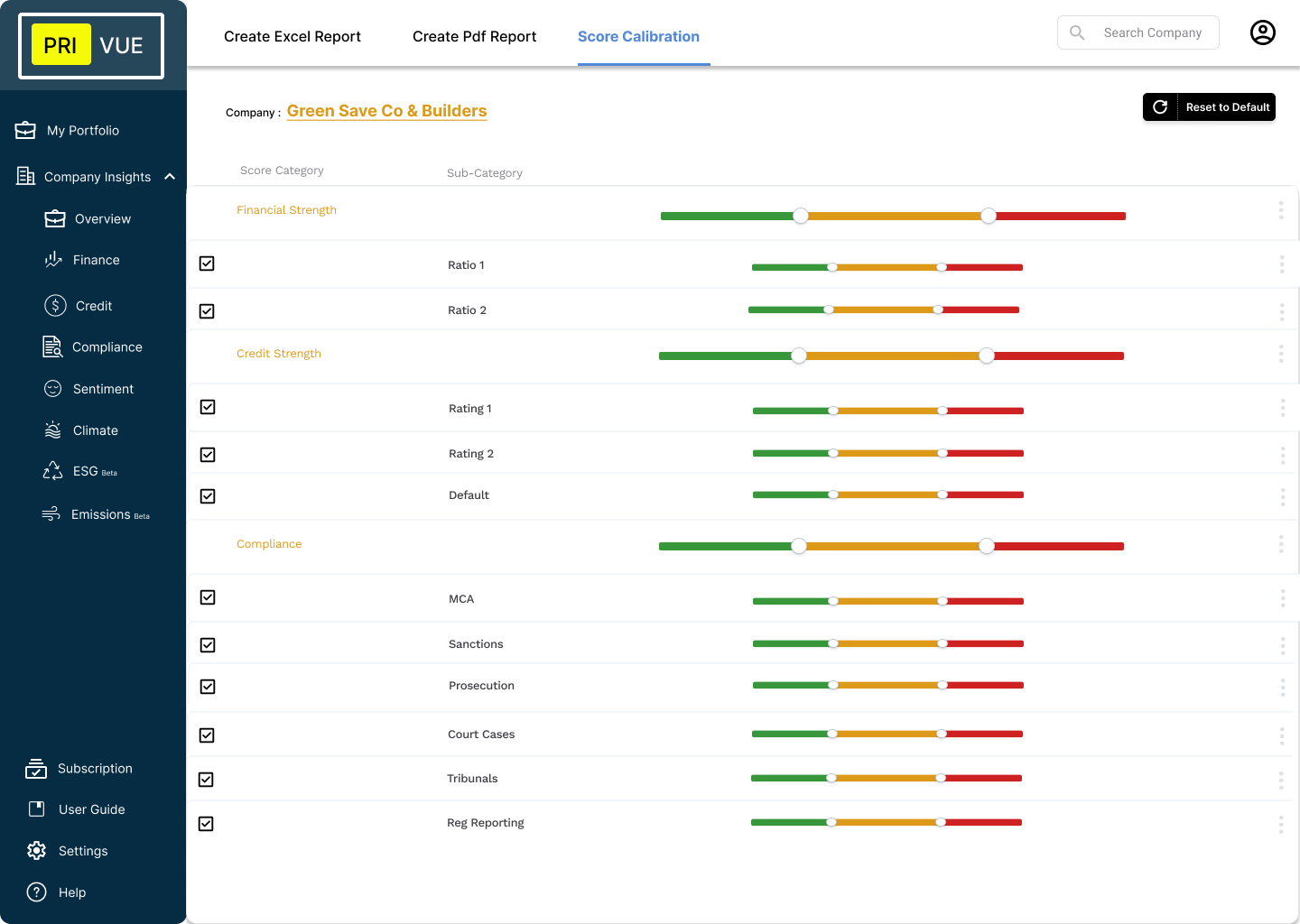

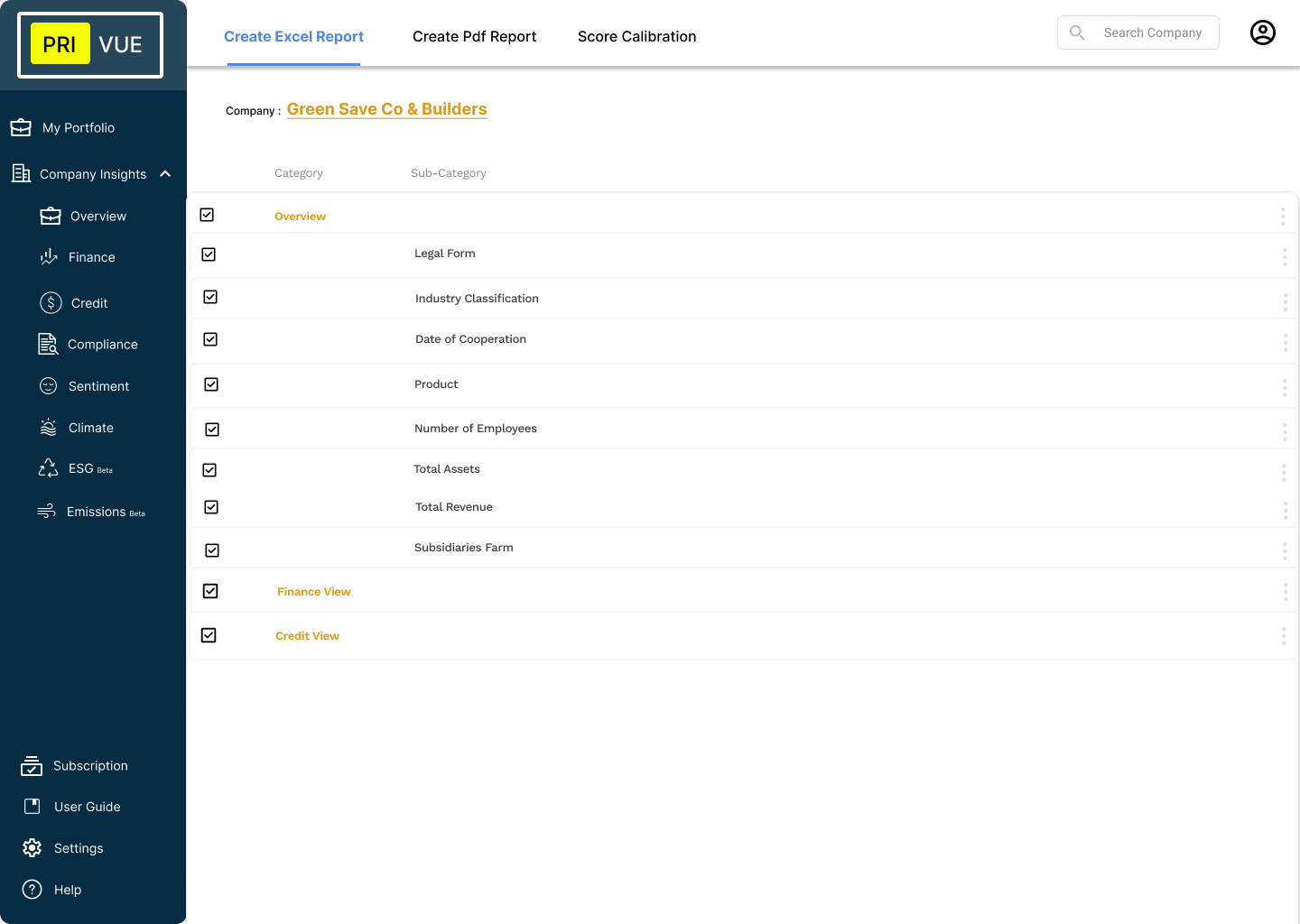

The ERM Dashboard is designed as a multi-dimensional platform, integrating a range of analytical needs:

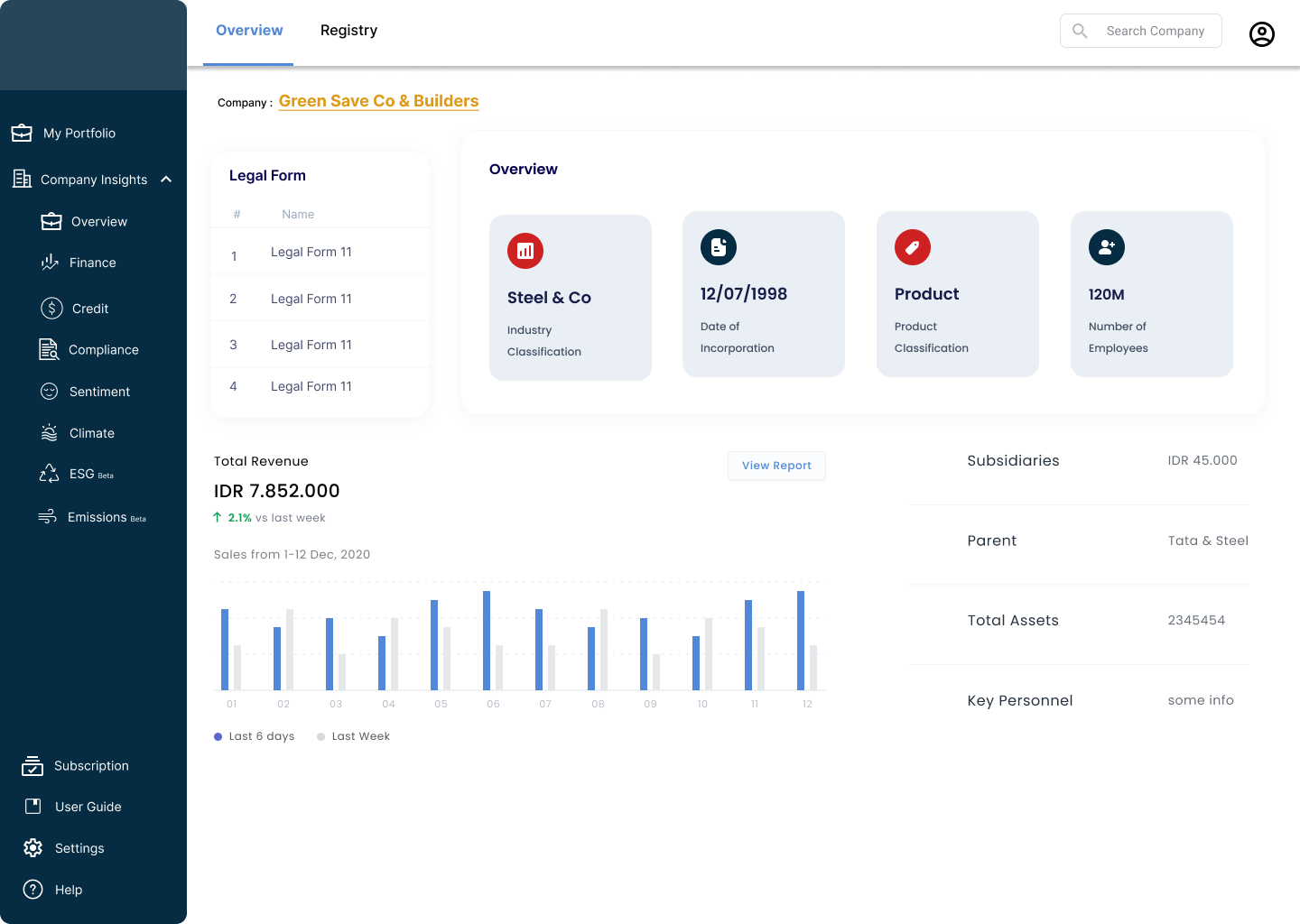

Integrated Company Overview:Provides a unified view of the company’s health, strategy, and market position, aiding in strategic decision-making.

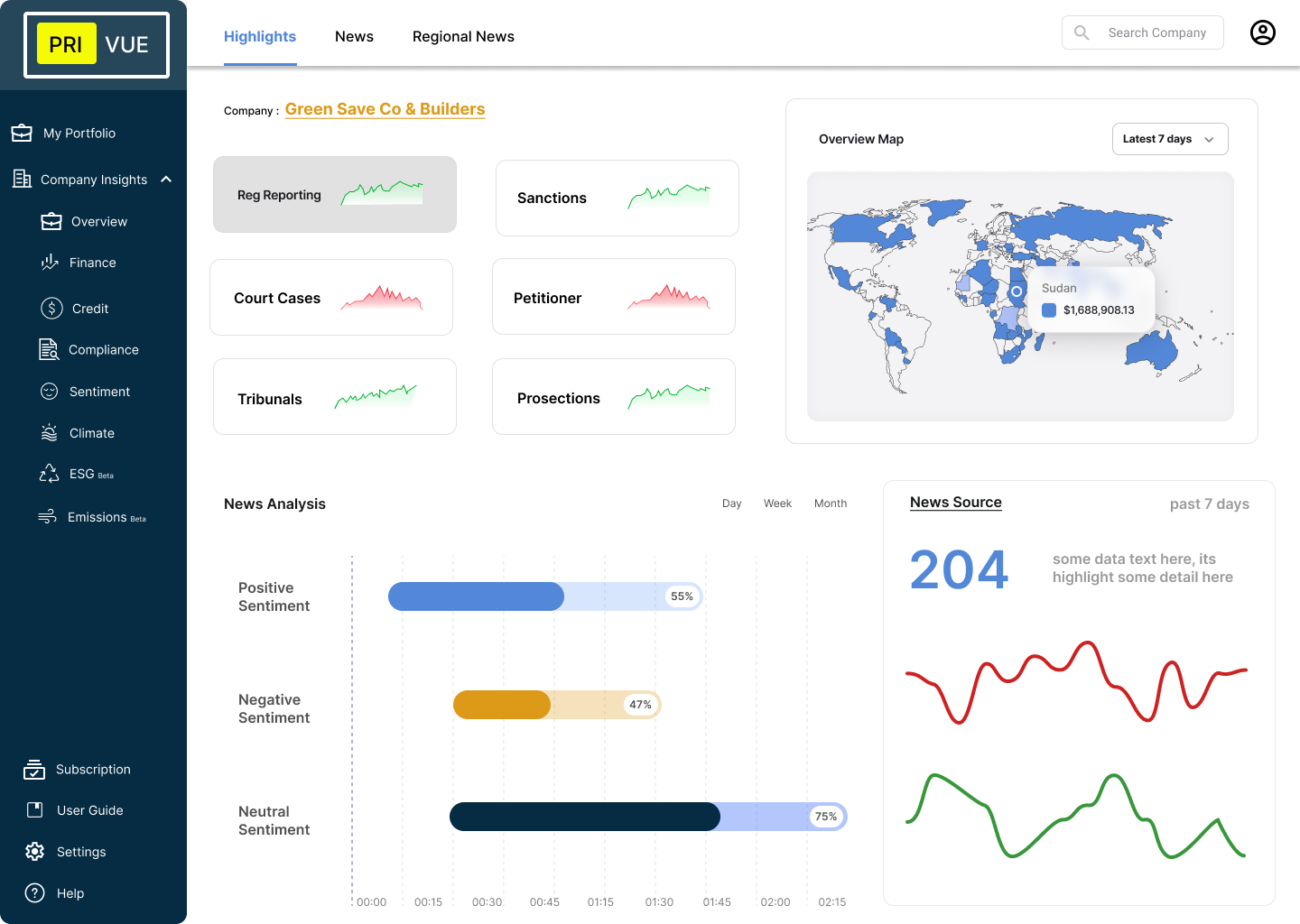

Legal and Compliance Monitoring: Offers real-time updates and alerts on legal actions and regulatory compliance, ensuring proactive risk management.

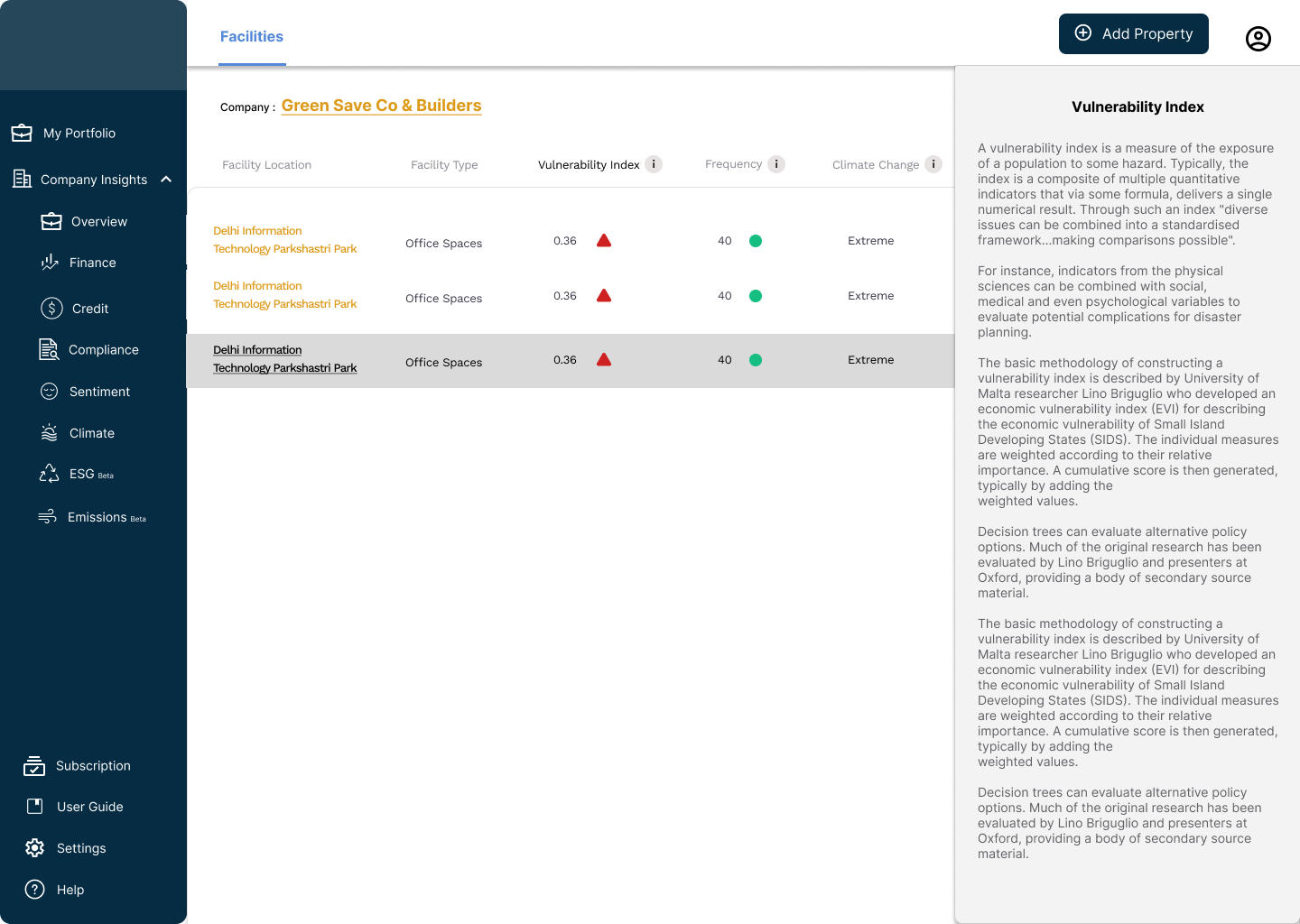

Environmental and ESG Insight: Delivers detailed assessments of environmental impact, carbon footprint, and ESG adherence, supporting sustainable business practices.

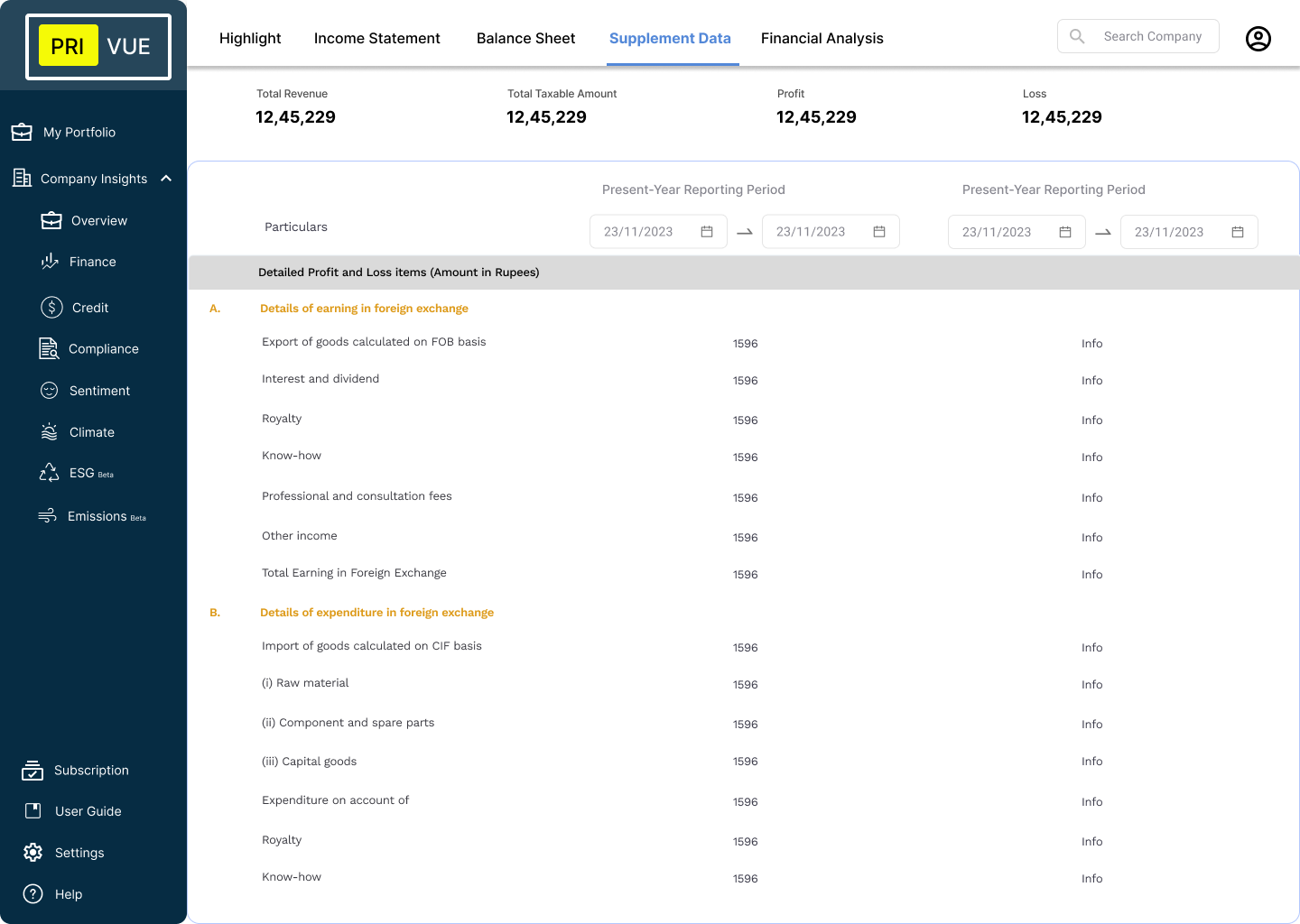

Financial Analysis: Includes deep dives into financial health with actionable insights into profitability, losses, and the financial wellness of associated entities.

Benefits:

Holistic View: Integrates multiple data sources for a unified perspective on risk management.

Proactive Management:Enables timely responses to legal and compliance issues.

Sustainability Alignment: Assists in aligning with global sustainability goals.

Informed Decision-Making: Provides insights that drive strategic decisions and enhance organizational growth.

User Experience Design

Intuitive Navigation and Aesthetics

The user-centric design includes -

Intuitive Navigation:Structured to facilitate easy access to complex information, enhancing user efficiency.

Aesthetics: Uses a calming color scheme and clean typography to reduce visual fatigue and improve readability.

Benefits:

Enhanced Usability: Simplifies interaction with the platform, making risk management more accessible.

Focused Experience: Reduces distractions and enhances productivity through a clear and organized interface.

Outcome & Value Proposition

Strategic Advantages Unlocked. The ERM Dashboard has empowered the client with: Agile Decision-Making: Enhanced capacity for quick and informed decisions based on comprehensive risk insights.

Streamlined Compliance Tracking: Efficiently manages regulatory compliance and risk exposures.

Operational Excellence: Reveals opportunities for operational improvement and strategic growth.

Benefits:

Growth and Stability: Supports long-term organizational growth and stability through advanced risk management and strategic insights.

Product Accessibility & Additional Resources

Deep-Dive Into Functional Excellence:

Explore the detailed design and functionalities of the ERM Dashboard via the Figma file link provided. This resource offers a thorough tour of the dashboard’s architecture and capabilities.

Benefits:

In-Depth Understanding: Provides transparency into the design and functionality, enhancing appreciation of the platform’s capabilities. more accessible.

Service Model & Client Empowerment

Scalable Solutions Tailored to Evolving Needs:

Our service model includes:

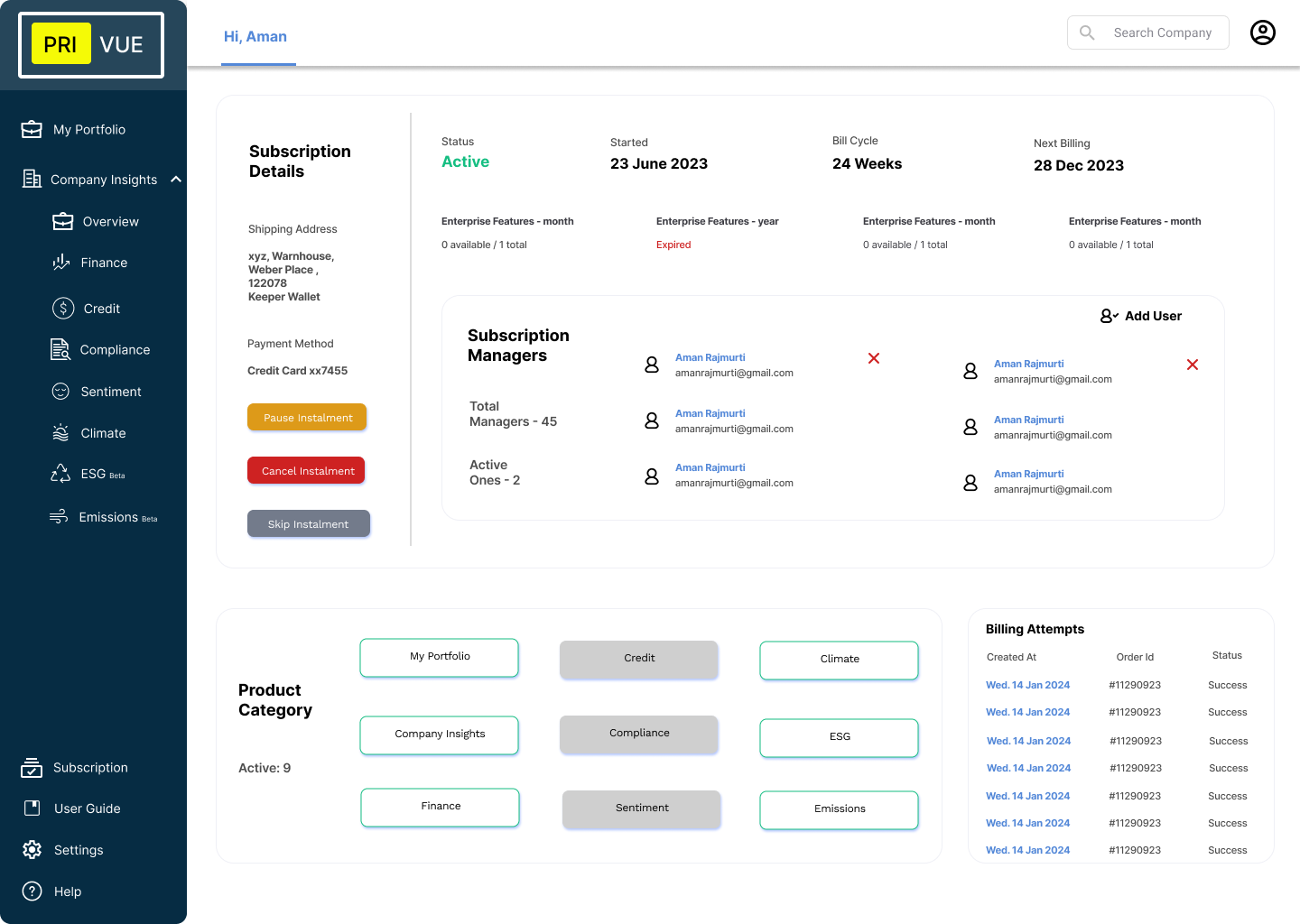

Freemium Package: Introduces users to core features at no cost.

Scalable Premium Features: Offers advanced functionalities as clients' needs evolve, ensuring continued support for growing organizations.

Benefits:

Flexibility: Adapts to varying needs with scalable solutions, growing alongside clients' businesses.

Future Enhancements

Ongoing Development

To maintain the platform's competitive edge and address emerging needs, future enhancements include:

Advanced AI Analytics: Integration of AI-driven analytics for predictive risk assessments and trend analysis.

Enhanced ESG Metrics: Expansion of ESG tracking capabilities to include more granular environmental impact data and social responsibility metrics.

Customizable Dashboards: Introduction of customizable dashboard views for personalized data presentation and reporting.

Integration with Emerging Technologies: Support for integration with new technologies and platforms to enhance data connectivity and interoperability.

Benefits:

Innovative Insights: Keeps the platform at the forefront of risk management technology.

Personalization:Provides users with tailored data views and reporting options.

Future-Proofing: Ensures compatibility with evolving technological landscapes.

ROI and Impact Metrics

Quantifiable Benefits:

The ERM Dashboard has demonstrated significant ROI and impact through:

Increased Efficiency: Reduction in time spent on data consolidation and risk analysis by 40%, resulting in faster decision-making processes.

Enhanced Compliance: Improved regulatory compliance tracking with a 30% reduction in compliance-related incidents.

Sustainability Impact: Enhanced ESG tracking has led to a 25% improvement in sustainability metrics and reduced carbon footprint.

Financial Performance: Organizations utilizing the dashboard have reported a 15% increase in profitability due to better financial insights and risk management.

Benefits:

Cost Savings: Efficient data management and risk analysis translate to cost savings and operational improvements.

Risk Reduction: Provides users with tailored data views and reporting options.

Sustainability Achievement: Better ESG tracking supports corporate sustainability goals and improves public image.

Conclusion

The Risk Management Portfolio stands as a transformative tool for modern enterprises, offering a comprehensive framework for managing risks across various domains. With its robust features, intuitive design, and strategic benefits, it empowers organizations to navigate complex risk environments effectively. This case study underscores the thoughtful design, innovative features, and significant impact of the Risk Management Portfolio, highlighting its role as a critical asset for organizational success.

More information: mailgauri@duck.com